59% of accountants use AI to save about 30 hours a week

Accounting Today

APRIL 9, 2024

A recent poll of U.S. and U.K. accountants has found that 59% say they use AI at work, and through AI have saved about 30 hours a week.

Accounting Today

APRIL 9, 2024

A recent poll of U.S. and U.K. accountants has found that 59% say they use AI at work, and through AI have saved about 30 hours a week.

Insightful Accountant

APRIL 10, 2024

Accounting profession faces staffing shortages due to fewer graduates and an aging workforce. 42% of firms turn away work, 24% near burnout. First-time CPA exam candidates dropped by 33% from 2016 to 2021.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CPA Practice

APRIL 9, 2024

By Irana Wasti. The adoption of a new product or technology tends to follow a familiar cycle. First, there is skepticism about whether it will live up to the hype. A few proven use cases later, people are talking about whether it will enhance or upend their professional lives. Before we reach the final stage where the technology is widely adopted, we pass through a period of uncertainty, where we wonder if this technology will be too helpful — to the point of being a threat to job security.

Insightful Accountant

APRIL 8, 2024

Amid COVID-19, US relief programs like PPP and unemployment aid were exploited by fraudsters, resulting in $80B stolen from PPP and $90-400B from unemployment relief. This fraud may rival $579B for Biden's infrastructure plan.

Speaker: David Warren

Transitioning to a usage-based business model offers powerful growth opportunities but comes with unique challenges. How do you validate strategies, reduce risks, and ensure alignment with customer value? Join us for a deep dive into designing effective pilots that test the waters and drive success in usage-based revenue. Discover how to develop a pilot that captures real customer feedback, aligns internal teams with usage metrics, and rethinks sales incentives to prioritize lasting customer eng

Ryan Lazanis

APRIL 10, 2024

Dive into the world of offshore accounting: Discover benefits, challenges, and best practices in this comprehensive guide. The post Offshore Accounting: Everything You Need to Know appeared first on Future Firm.

Canopy Accounting

APRIL 10, 2024

For the accounting firm focused on maximizing profit and efficiency, antiquated practice management solutions that only meet a few needs are no longer sufficient for accounting firms. Having an operating system that seamlessly connects all processes within an accounting firm is crucial for maximizing efficiency and providing a superior client experience.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

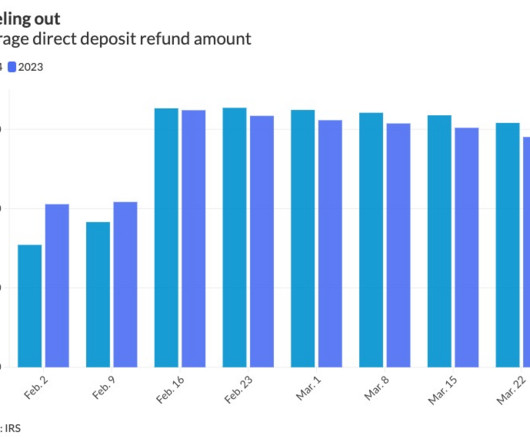

Accounting Today

APRIL 9, 2024

At 90,315,000, the number of individual returns received this tax season finally surpassed the same period last year, up 0.2% as of March 29, 2024.

CPA Practice

APRIL 9, 2024

By Nellie Akalp. As accountants and CPAs, dealing with payroll taxes is essential to managing finances for your business clients. Understanding the details of payroll taxes helps you better assist your clients in fulfilling their obligations and maximizing tax efficiency. The ever-changing complexities of payroll taxes can often seem overwhelming, especially for business owners, so we’ve compiled an easy guide you can share with them.

TaxConnex

APRIL 9, 2024

The common definition of dietary supplements and vitamins is a non-food item that includes a vitamin, mineral, herb, botanical, amino acid or dietary substance. For purposes of incurring sales tax in any state, that essentially translates into “sometimes.” Sometimes a state considers supplements and vitamins as drugs, groceries or food. Sometimes these products are taxable tangible personal property, sometimes not.

MyIRSRelief

APRIL 12, 2024

Tax debt can be a significant burden, causing stress and financial strain for many individuals. However, there are several avenues for tax relief available to those who owe the IRS. This comprehensive guide will explore the options for obtaining tax relief, aiming to provide clarity and hope to those grappling with tax debt concerns. Get professional representation today!

Advertisement

The first Market Momentum Index: AI and Unstructured Data Management, conducted by Deep Analysis with support from AIIM and M-Files, surveyed 500 enterprises across various industries to assess their readiness to employ AI. The results reveal that AI is already far more embedded into organizations' operations than previously realized. These findings and more insights have been brought to you in the "Market Momentum Index: AI and Unstructured Data Management.

BurklandAssociates

APRIL 9, 2024

HR recordkeeping is one of the last things most startup founders want to think about, but non-compliance can lead to major fines, reputation damage, and due diligence pitfalls. The post Navigating HR Compliance: Recordkeeping Essentials for Startups appeared first on Burkland.

Withum

APRIL 10, 2024

In a recent development that underscores the dynamic landscape of Artificial Intelligence (AI) within government, the U.S. House has blocked the utilization of Microsoft’s Copilot by its staff, representing a noteworthy chapter in the ongoing narrative of AI’s journey through the hype cycle. Just as AI approaches the summit of the Peak of Inflated Expectations, there emerges a concerted effort, notably from the media, to hasten its descent into the Trough of Disillusionment.

Going Concern

APRIL 9, 2024

The annual 100 Best Companies to Work For list from Fortune and Great Place To Work® is out and once again a lil firm from Michigan has the honor of being best-er than the accounting firms that follow it. Everyone, let’s congratulate Plante Moran for another impressive showing and coming in 12th on the 2024 list. This year, they only narrowly beat out Deloitte again.

Accounting Today

APRIL 10, 2024

The board imposed its largest-ever penalty of $25 million against KPMG's firm in the Netherlands, in addition to $2 million in fines against Deloitte's firms in Indonesia and the Philippines.

Speaker: Mark Stovel

When it comes to automating, many firms focus on finding the latest tech, believing that efficiency is something achieved through new tools. Yet true efficiency is achieved by delivering real value to clients, not merely by upgraded systems. Without a clear approach, no level of automation can overcome the complexities of serving every client’s needs.

CPA Practice

APRIL 9, 2024

In an email to tax professionals on April 5, the IRS said it’s making changes that will impact how practitioners obtain a client’s tax transcripts, as part of the agency’s efforts to combat identity theft and protect taxpayers’ personal information. Starting April 8, tax professionals must now call the Practitioner Priority Service (PPS) to request transcripts to be deposited into their Secure Object Repository (SOR).

Withum

APRIL 12, 2024

Withum Soars on Vault Top Accounting Firm List Vault named Withum #17 on their annual top 25 accounting list. Known for its influential ranking, Vault recognized Withum for their outstanding training programs, benefits and compensation. Over the years, the Vault survey has consistently shown that Withum Team Members accept positions and remain at the Firm for the unbeatable culture and outstanding colleagues.

Going Concern

APRIL 9, 2024

I think I have something interesting for you today. Fresh academic research has found that audit seniors are more likely to offer better constructive feedback and coaching to their juniors via review comments if the seniors think they’ll be working with that staff again. The paper “ Coaching Today’s Auditors: What Causes Reviewers to Adopt a More Developmental Approach?

Accounting Today

APRIL 11, 2024

The Institute of Management Accountants is examining the possibilities of artificial intelligence in the accounting profession while undergoing staff cutbacks.

Advertisement

With automation, you’ll reduce errors and save valuable time, allowing you to focus on what really matters: strategic analysis and insightful decision-making. Picture accurate financial reports ready at your fingertips, giving you the confidence to tackle business challenges head-on. Embracing automation not only boosts productivity but also elevates your role from number cruncher to closing rockstar.

CPA Practice

APRIL 9, 2024

Let’s face it, the accounting profession has developed a bad reputation – toiling through long hours chained to a desk, crunching numbers, deciphering archaic tax codes and grinding out tedious tasks, all for lower starting pay and heavy licensing requirements. The sector is at an inflection point with staffing challenges – one that offers both risk and opportunity.

Cherry Bekaert

APRIL 9, 2024

On campuses around the country, the name, image and likeness (NIL) policy is revolutionizing the way student-athletes can obtain benefits while attending a college or university. As of July 2021, student-athletes can enter NIL deals if they comply with state law and the NCAA’s rules. Essentially, NIL allows college athletes to monetize their personal brand by profiting from their name, image and likeness through various opportunities such as endorsements, sponsorships, social media posts and mor

Going Concern

APRIL 7, 2024

The irony of me writing and publishing this on a Sunday. On April Fools’ Day, California Assemblymember Matt Haney announced he’s introduced AB 2751 , a proposal that “guarantees California workers uninterrupted personal and family time by creating a ‘right-to-disconnect’ from emails, texts, and calls after work hours.” His office’s statement explains : The bill mandates that all California employers create and publish company-wide action plans to implem

Accounting Today

APRIL 10, 2024

Plus, Google is making massive changes to Chrome, AI-powered tax chatbots aren't performing well, and seven other things that happened in technology this past month.

Advertisement

Setting the stage for successful organizational change always begins with clear, thoughtful communication. When it comes to rolling out a new travel and expense (T&E) policy, establishing a well-structured communication plan is key to ensuring that all employees understand the changes and their impact. By following a step-by-step approach, you can guide your organization through the transition, fostering smooth adoption from the outset and improving compliance.

CPA Practice

APRIL 8, 2024

With the increasing complexity of tax laws and regulations, tax professionals are constantly facing challenges in keeping up with the ever-changing landscape. CPA Pilot ‘s AI tax assistant leverages advanced algorithms to analyze data and offer precise insights quickly. This enables tax professionals to prioritize strategic tasks. CPA Pilot allows tax experts to focus on strategic and value add tasks for their clients and reduce the intensity of tax season.

Withum

APRIL 9, 2024

Withum is proud to announce that Chris has earned a spot on the Inside The Valley’s list for the second consecutive year. Chris is Partner-in-Charge of Withum’s Los Angeles office and has over 24 years of experience in the industry specializing in assurance and business consulting services to emerging and middle-market companies. As a prominent networker and influencer, Chris reaches a broad professional audience through his work as the Social Media CPA and as an active member of ProVisors and t

Going Concern

APRIL 12, 2024

In a renewed effort to appear to be doing something of value, the PCAOB was busy this week handing down hand slaps and fines for the crime of sharing answers on internal training. We were a bit too focused on KPMG Netherlands receiving the biggest fine the PCAOB has ever given out ($25 million) to mention that Deloitte Philippines and Deloitte Indonesia had fines of their own announced the same day.

Accounting Today

APRIL 11, 2024

From BOI reporting to tax legislation in limbo, even the most 'normal' filing season in a several years still has unresolved questions.

Speaker: Michael Mansard and Katherine Shealy

Generative AI is no longer just an exciting technological advancement––it’s a seismic shift in the SaaS landscape. Companies today are grappling with how to not only integrate AI into their products but how to do so in a way that makes financial sense. With the cost of developing AI capabilities growing, finding a flexible monetization strategy has become mission critical.

CPA Practice

APRIL 8, 2024

By Kathryn Pomroy, Kiplinger Consumer News Service (TNS) The idea of a comfortable retirement just got a lot more expensive, and for some, it may be entirely out of reach. Most retired Americans believe they will need nearly $1.5 million in the bank to retire comfortably, according to a new study. The majority of retirees surveyed believe that they will need $1.46 million in the bank to retire comfortably, according to Northwestern Mutual’s 2024 Planning & Progress Study.

Insightful Accountant

APRIL 11, 2024

Taxpayers who can't pay their tax bill by the April 15, 2024, deadline shouldn't panic – the IRS is here to help. There are several options to help taxpayers meet their obligations.

CTP

APRIL 10, 2024

In a previous blog , we discussed the benefits of the 1031 exchange. This IRS rule allows property owners to defer capital gains taxes when they trade a property for a like-kind property. So if your client has a property that is used for business or held as an investment and exchanges it for another property that is used for business or held as an investment, they may qualify for 1031 treatment.

Accounting Today

APRIL 9, 2024

The Internal Revenue Service urged tax professionals to steer clear of so-called "spearphishing" scams from cybercriminals, including identity thieves posing as new clients.

Speaker: Genevieve Hancock, CPA

Cash flow isn’t just about balancing numbers - it's about ensuring your organization is positioned for both immediate stability and long-term success. Understanding that cash flow management fuels every decision, every opportunity, and every growth phase is critical. But how can you shift from simply managing cash to strategically optimizing it for resilience?

Let's personalize your content